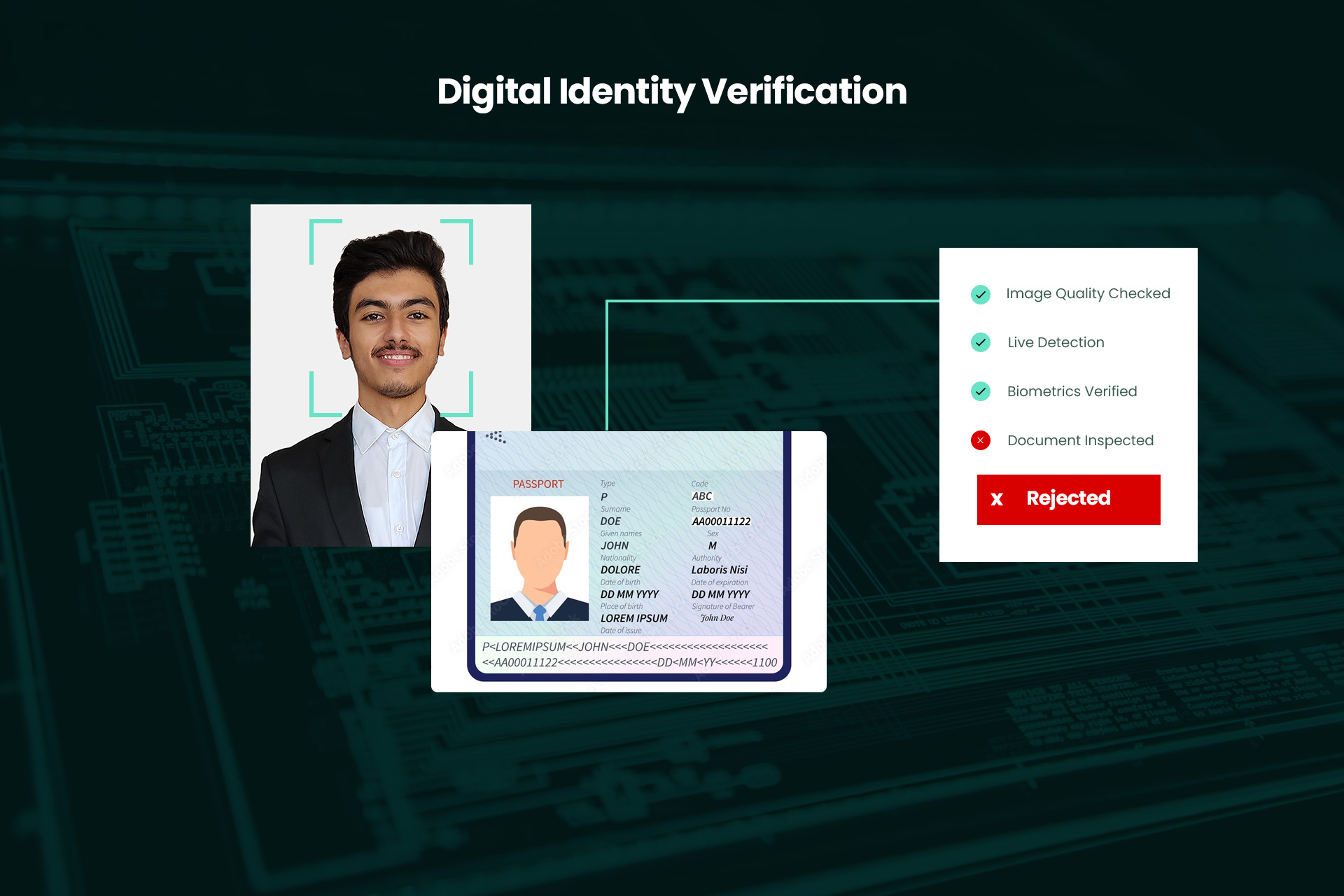

Digital Identity Verification

-

PorjectAcademic

-

Year2024

-

TypeWeb Services & API

About

This project addresses the security challenges prevalent in the Tunisian market, specifically the lack of advanced technologies for digital identity verification. The evolving landscape of cyber threats necessitates advanced security solutions, especially in the financial sector, where the risk of spoofers and cyber attacks is high. This deficiency in comprehensive digital identity verification tools hinders the growth of online financial services in Tunisia, limiting the option for individuals to open bank accounts virtually due to security concerns.

Problematic

In Tunisia, the financial sector faces significant security challenges due to the lack of advanced digital identity verification technologies. This gap exposes online financial transactions to cyber threats and spoofing, preventing widespread adoption of virtual banking services. The inability to securely verify digital identities hampers the growth of online financial services and restricts individuals from opening bank accounts virtually.

Solution

RyanBOT is a Financial Virtual Assistant API designed to address these security challenges by offering advanced digital identity verification solutions. It incorporates multiple security layers and artificial intelligence technologies, such as TOTP (Time-based One-Time Password), facial recognition, and face liveness detection. These features ensure a secure and seamless user authentication process. Beyond identity verification, RyanBOT also provides chat-based financial consultations, an efficient expense tracking system, and meeting scheduling.

User Flow:

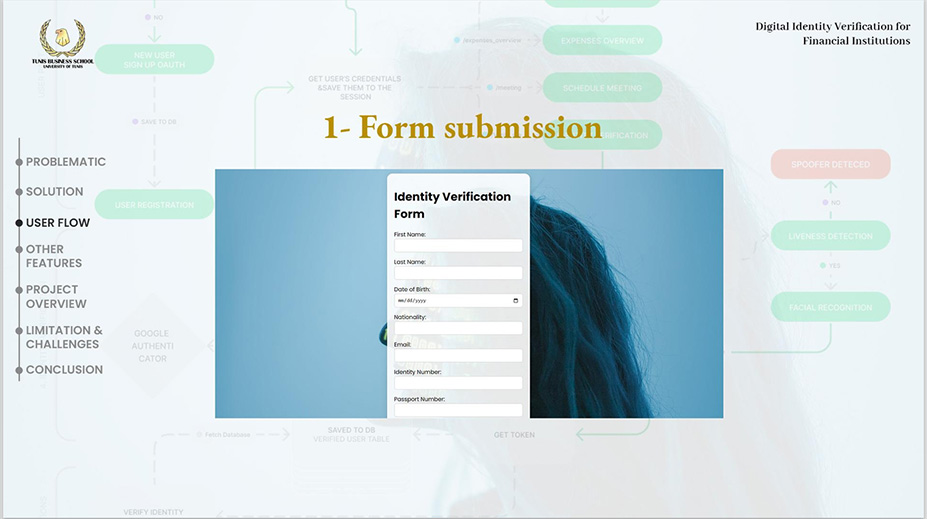

1- User Registration and Identity Verification:

Step 1: The user starts by accessing RyanBOT through a web interface or mobile app. They log in using OAUTH for Gmail verification, ensuring a secure initial login.

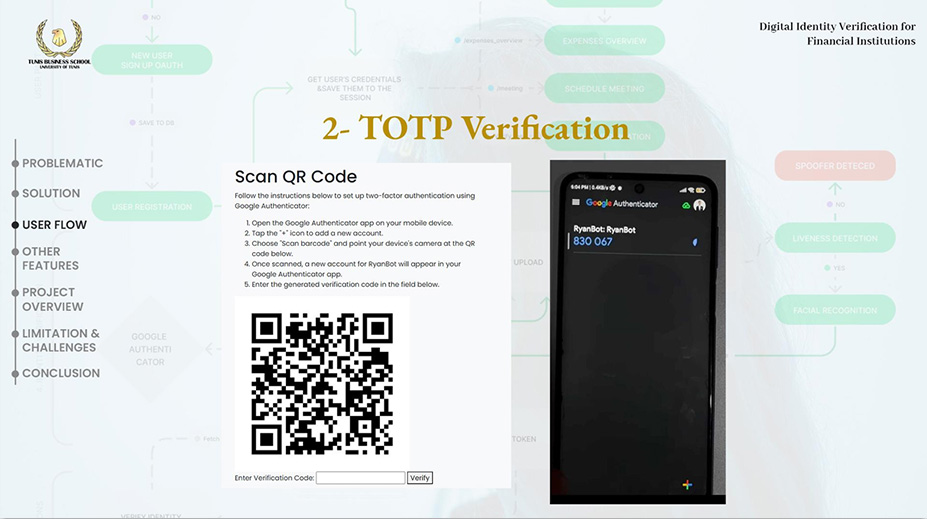

Step 2: After logging in, the user is prompted to set up TOTP using an external security app. This adds an extra layer of security.

Step 3: RyanBOT manually adds the user's basic data to the system for initial setup.

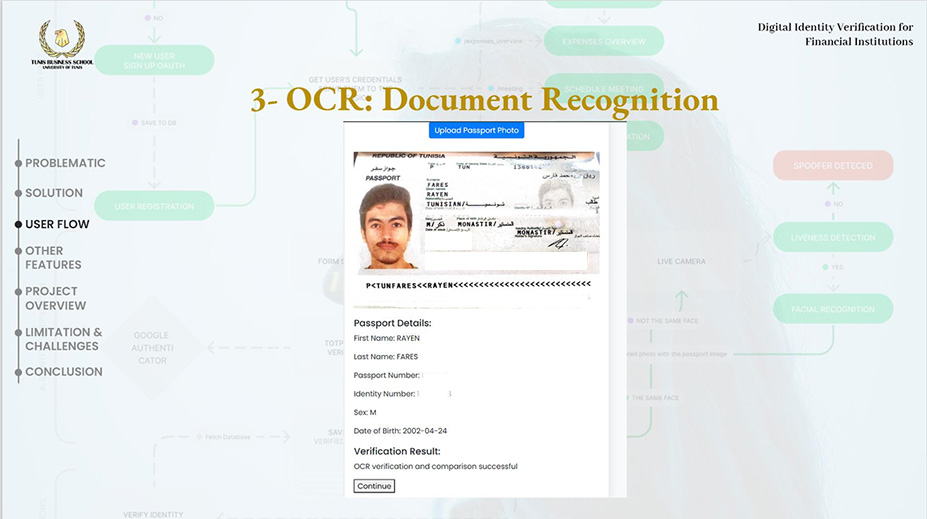

Step 4: The user uploads their passport. RyanBOT uses OCR (Optical Character Recognition) to check and verify the passport's existence.

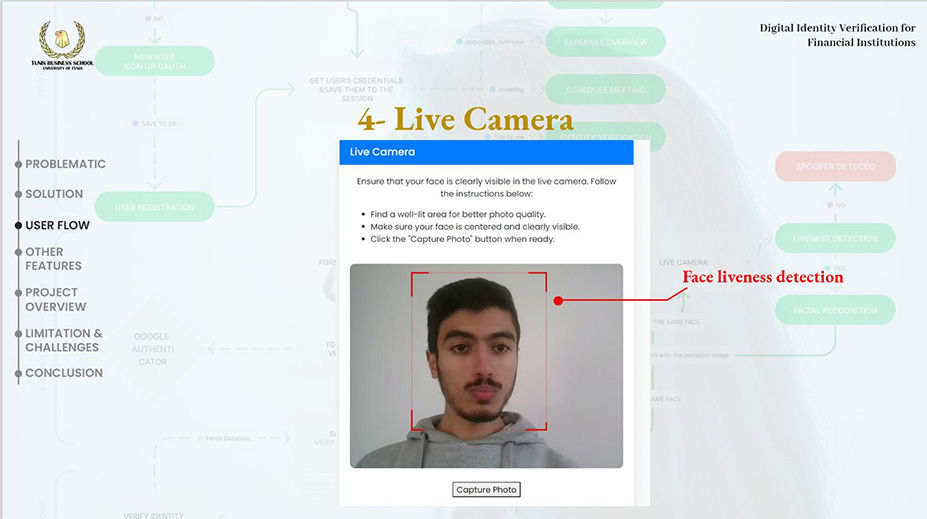

Step 5: RyanBOT initiates facial recognition to detect the user's liveness first, ensuring that the person is real and not using a photo or video.

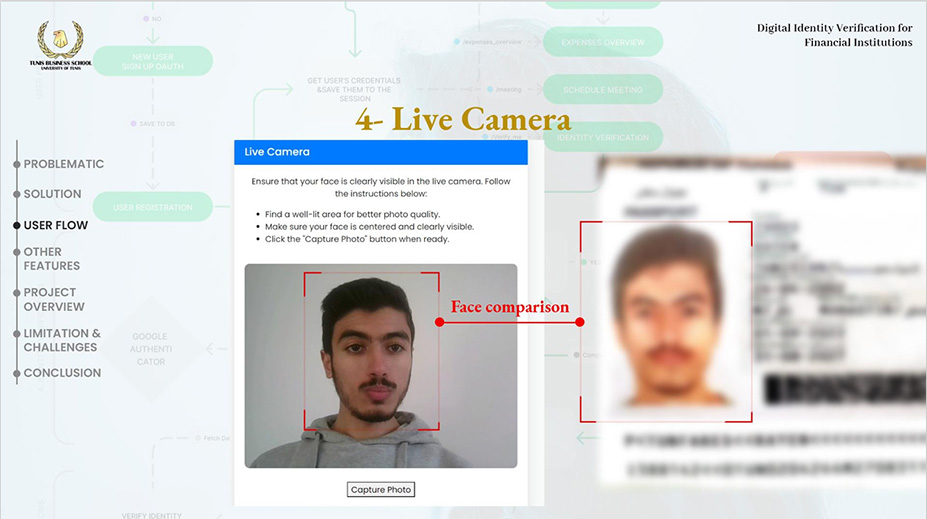

Step 6: After liveness detection, RyanBOT compares the user's facial image with the photo on the passport to ensure a match.

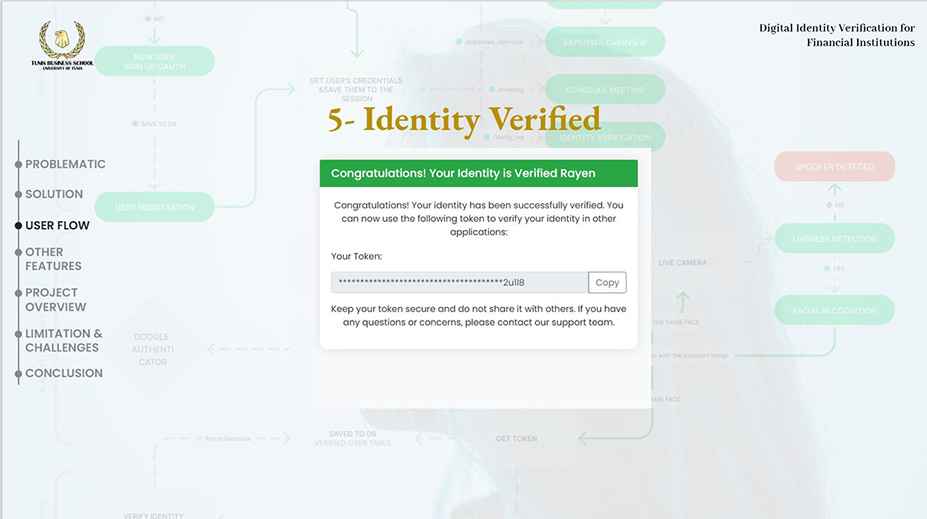

Step 7: Once verification is successful, RyanBOT grants the user a digital identity verification token. This token can be used as proof of digital identity verification.

2- Logging In:

After successful registration, the user logs in using TOTP for enhanced security.

RyanBOT verifies the user's credentials securely before granting access.

3- Accessing Financial Services:

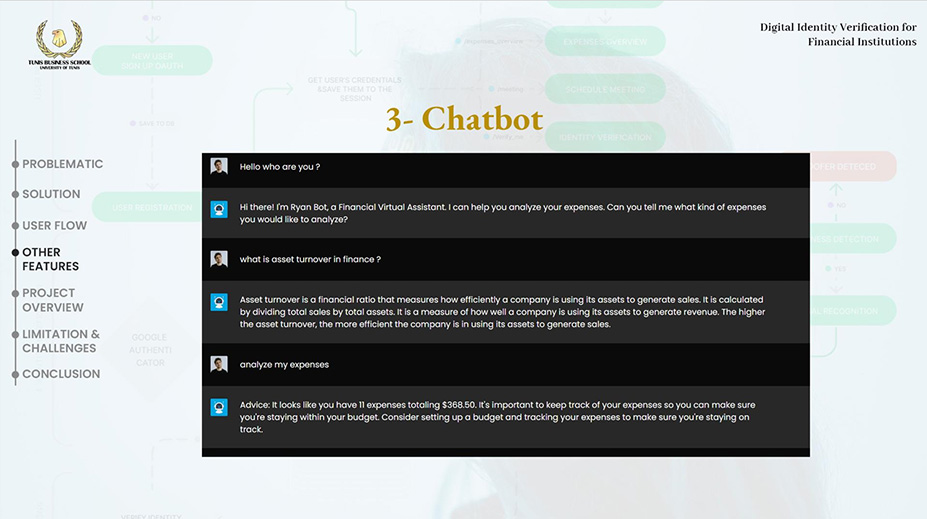

Once logged in, the user navigates to the desired services, such as financial consultations or expense tracking.

For financial consultations, the user interacts with RyanBOT via chat, receiving tailored advice.

For expense tracking, the user inputs financial data, and RyanBOT categorizes and analyzes expenses.

4- Meeting Scheduling:

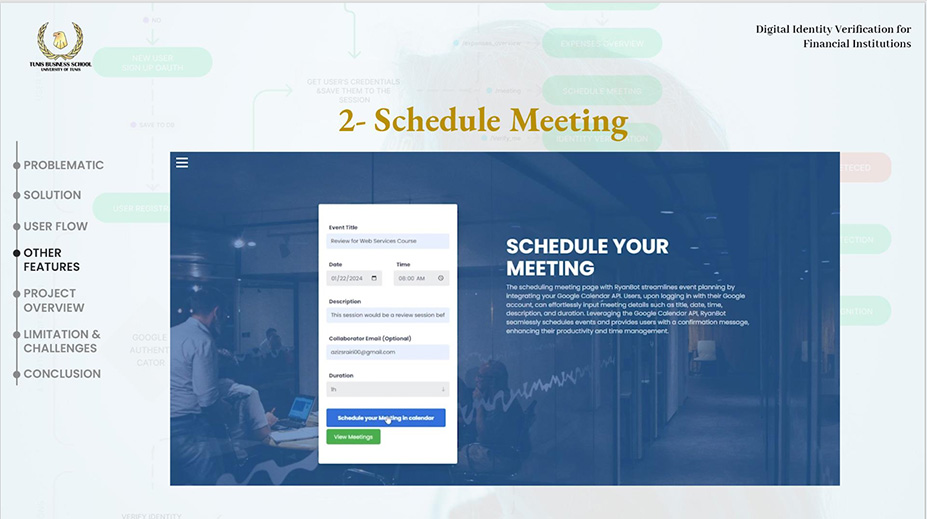

The user requests to schedule a meeting through the chat interface.

RyanBOT accesses the user’s calendar to find available slots.

The user confirms the preferred time, and RyanBOT sends a meeting invitation.

5- Logging Out:

After completing their tasks, the user can safely log out of their RyanBOT account.

RyanBOT ensures that the user's session is ended securely.